Quarterly market commentary - September 2024

Markets continued to deliver pleasing investment results in the third quarter of 2024.

With the daily news out of the Middle East and Ukraine providing an ongoing reminder that the world still faces serious geo-political issues, investment markets have maintained a relatively steadier course.

Most major economies continued to focus on delivering an economic ‘soft landing’ – i.e. cooling high levels of demand and inflationary pressures without pushing their economies into recession.

For this reason, the US Federal Reserve announcement on 18 September was noteworthy, as it finally began easing the Federal Funds Rate with an initial cut of 0.50%. The interest rate cut was based on a view that the risks to inflation had declined, while the risks on an economic slowdown and higher unemployment had increased.

This meant the US now joined the ‘rate-cutting club’ already occupied by the European central bank, Canada, UK and New Zealand and their actions clearly highlighted that the pathway for global interest rates is now downwards, at least for now.

Uncertainty about the near-term strength of global economic activity can be seen in weaker commodity prices such as energy (oil prices are currently down about 20% year on year) and steel, although copper (used in construction and manufacturing) has recorded price rises from a low base.

While three months may be a blink-of-an-eye in the world of investing, it is a lifetime in politics. In July we were talking about the intriguing build-up to Donald Trump and Joe Biden once again going head-to-head for the US presidency in November. Today, Biden is no longer in the race, having been replaced as the democratic candidate by the current vice president, Kamala Harris. And, given the unusual electoral college system that ultimately decides the presidency, this contest still looks too close to call.

The long-awaited US interest rate reduction

Globally, interest rates were cut to historically low levels following the emergence of Covid-19 in early 2020. Fearful of the impact that Covid-19 could have on the global economy, policymakers kept interest rates low for several years to hopefully reduce the potential risk of wholesale business failure, and significant unemployment, due to lock downs and border closures. Both of those outcomes looked possible during the highly uncertain early months of the pandemic.

However, as global health fears receded, economic fears also eased, and workers and businesses eventually returned to a post-pandemic version of ‘normal’. Unfortunately, the significant monetary and fiscal stimulus that had been added to the system in the form of historically low interest rates and direct monetary payments from governments, had combined to form a sizable inflationary bubble around the world. With the price of many goods and services having rapidly increased, it contributed to what we still refer to in New Zealand as the cost-of-living crisis.

With the US Federal Reserve announcing a 0.50% interest rate reduction in September, there is growing evidence that global interest rates are on their way down.

As economic data points supported the increasing likelihood of the pending Federal Reserve’s announcement, sharemarkets have been moving higher. This is often the sharemarket reaction when interest rates are thought to be heading lower. While a stronger sharemarket is usually always well received by investors, perhaps a bigger question for many in New Zealand is – do lower US interest rates have any implications on mortgage rates here?

In New Zealand, mortgage interest rates are heavily influenced by the Reserve Bank of New Zealand's monetary policy decisions, which are mainly based on their assessment of domestic economic conditions, and inflation. However, if US interest rates drop, this can contribute to lower global lending costs, which can also help reduce New Zealand interest rates. So lower US interest rates might help take some pressure off total lending costs in New Zealand.

We have now seen our own central bank make two cuts to the official cash rate, which following the announcement on October 9 now sits at 4.75% after spending 12 months at 5.50%. Annual consumer price inflation is now within the 1 to 3 percent inflation target range and converging on the 2 percent midpoint. The next official cash rate announcement is 27 November, and with another 3 months before the following meeting in February 2025, the market is beginning to price another significant cut before Christmas.

What about the safety of cash?

High yielding cash accounts and term deposits can feel like a safe haven, especially in periods when uncertainty and share market volatility are high. However, while cash may be safe, parking too much of your money in cash for too long is usually a bad idea for long term investors.

While you’ll be protected in the event of a potential market crash, the long-term opportunity cost of staying in this lower returning asset is likely to be worse than the crash itself.

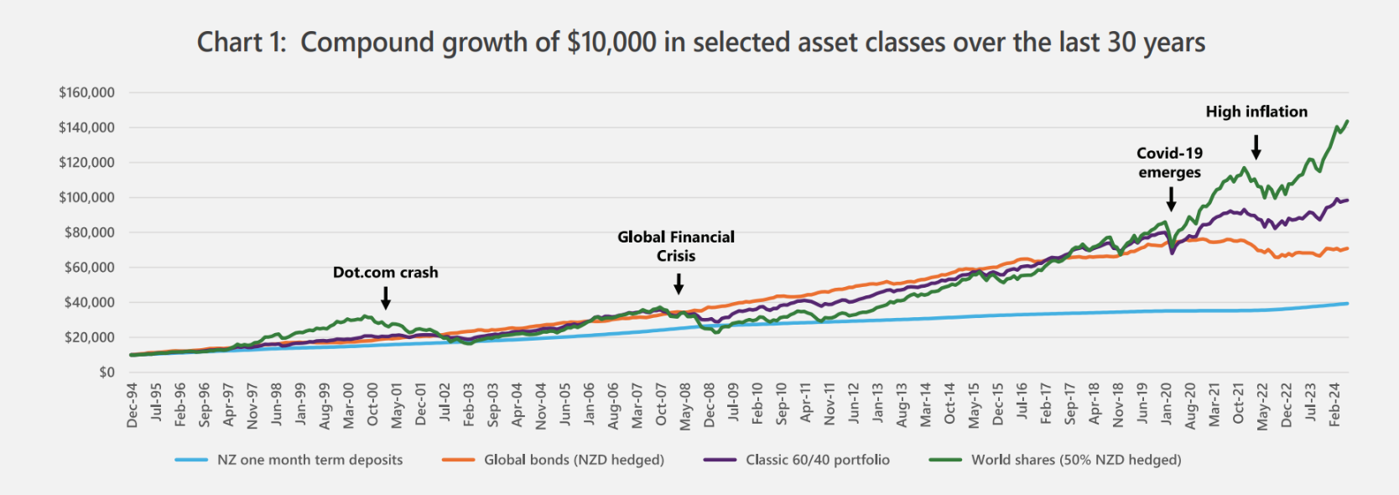

To illustrate this point, the chart below compares the following: the compound growth of returns (before any tax and fees) from global shares, a standard 60/40 diversified portfolio, hedged global bonds, and one month term deposits for the 30 years from the end of 1994 to June 2024.

Note - the above chart data is based on the following:

NZ one month term deposits – using the returns of the NZ One Month Bank Bill Yields Index

Global bonds (NZD hedged) – using the returns of the Bloomberg Global Aggregate Bond Index (NZD hedged)

Classic 60/40 portfolio – using the past actual and back-tested returns of the recommended 60/40 portfolio

World shares (50% NZD hedged) – using the returns of the MSCI All Country World Index (50% NZD hedged)

Despite some large sharemarket setbacks along the way, namely the post dot.com period, the Global Financial Crisis, the emergence of Covid-19 and the post-Covid high inflation period, the chart reveals that shares gained by a factor of 14x, while short term deposits gained 4x. A 60/40 portfolio, combining a mixture of higher and lower risk investments gained 10x.

Short term pain, longer term gain

Similar to the idea that staying too long in cash can be damaging to long term wealth creation, there are a number of perfectly normal behavioural impulses that good investors also need to continually manage. One of the most important is - resisting the urge to sell when markets suffer large corrections.

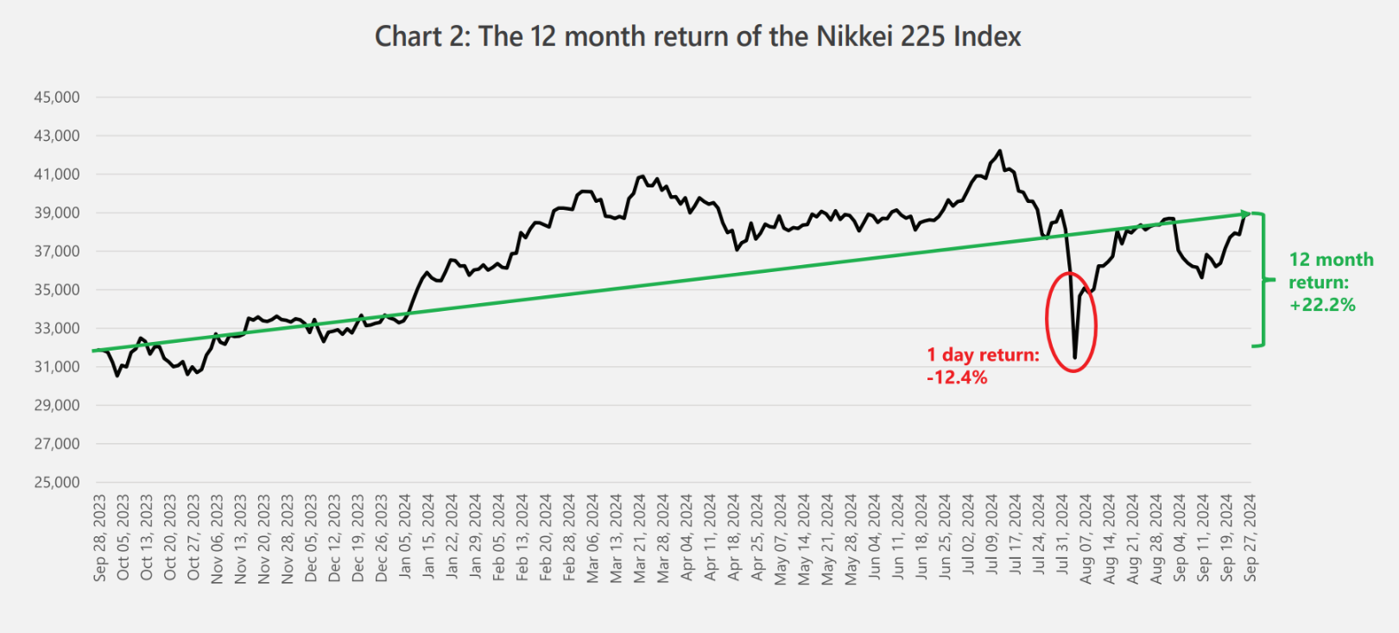

In our first Autumn quarter commentary this year, we highlighted the strength evident in the Japanese share market in early 2024. Then, on the 4 August, the headline Nikkei 225 Index fell -12.4% in one day. By any measure that’s a big fall and close to the largest single day decline ever in the Japanese share market.

That single day performance is highlighted in the chart below:

Source: investing.com

As tempting as it may have been at the time, exiting the market on this very negative day would have been a serious mistake. While it might have eased short term concerns, it would have meant missing out on the sharp recovery that commenced the very next day and which, at time of writing, had resulted in a gain of more than 20% from the 4 August low.

Over the last 12 months, as highlighted by the green dashed line, the Japanese market has experienced many peaks and a few troughs. This is the nature of investing in shares when prices can go up and down by large amounts. However, over time, the compensation for taking on the risk of investing in shares can be very rewarding, as seen in the Japanese share market over the last 12 months (up over 22% at time of writing).

But why did Japanese shares fall so much on this one day? Analysts said that a contributing factor was the unwinding of Japanese ‘carry trades’. In a carry trade, investors borrow money from a country with a low interest rate and a relatively weak currency (like Japan) and invest those funds into places or investments that will yield a higher return. However, following the Bank of Japan's decision to raise its key interest rate on 31 July, this meant a sudden increase in the cost of maintaining a Japanese yen carry trade, and contributed to some investors selling down shares to repay their carry trade loans.

The benefits of a diversified portfolio approach

Investing, when approached constructively, involves taking an appropriate level of investment risk with the objective of achieving a set of long-term financial goals and objectives.

That’s where any parallels between investing and trading shares in the short-term, buying gold, or buying a rental property usually end.

Yes, buying and selling shares (or other investments) can certainly be a form of investing but, as a generalisation, the aim of many short-term share traders is simply to make money. While making money might be a very welcome outcome, it’s not always a well-defined goal and, on its own, may not enable you to achieve more important goals in life.

This is where diversified investment portfolios can provide significant benefits, that most other single asset class exposures cannot. Most notably, diversified portfolios are more effective at delivering -

- Risk reduction - by spreading investments across various asset classes (local shares, international shares, bonds, cash, etc) investors can mitigate the impact of a poor performance in any single asset class. Also, in volatile markets, a diversified portfolio helps protect against significant losses, as not all investments will usually react the same way to market events. New Zealand shares were a prime example of this during the volatility in Japan this quarter; after lagging developed markets over the last couple of years our domestic sharemarket was resilient, helping reduce the short-term losses.

- A focus on long term growth - a diversified portfolio approach aligns well with long-term investment strategies, often focusing on gradual growth rather than on the unpredictability of short-term returns.

- Reduced emotional stress - a diversified portfolio can help to reduce investor anxiety during volatile markets, as it is much less likely to experience extreme highs and lows. And as different investments are likely to perform well at different times, diversified portfolios often lead to more stable and predictable returns over time, which is valuable for future planning.

While investing is easy, investing well is hard. Prudent diversification is often one important element of investing that most investors, on their own, tend to struggle with.

This is why taking professional advice than can be tailored to your personal circumstances, needs and risk preferences, is such an important component of long-term wealth creation. By embracing the benefits of portfolio diversification, it enables you to better manage risk and stress, on the pathway to financial security.

For a detailed review of the asset class performances for the quarter, see ‘Key market movements - September 2024’

Click here to view the full newsletter in PDF

Disclaimer

While every care has been taken in the preparation of this newsletter, Consilium makes no representation or warranty as to the accuracy or completeness of the information contained in it and does not accept any liability for reliance on it. Information contained in this newsletter does not constitute personalised financial advice and does not take into account your individual circumstances or objectives.

-

Key market movements - September 2024

The third quarter of 2024 saw positive performance across most asset classes, with central bank rate cuts buoying markets despite weakening economic data. Notably, emerging markets outperformed developed markets, while AI investments faced skepticism, and New Zealand shares delivered solid gains driven by rate cuts and corporate acquisitions.

-

Quarterly market commentary - September 2024

The third quarter of 2024 saw continued strong investment returns, with global interest rates beginning to decline, as central banks in the US, Europe, and beyond shifted focus towards managing economic slowdowns. While geopolitical issues remain a concern, markets have shown resilience, and lower interest rates may ease borrowing costs, positively impacting economies like New Zealand.

-

Top tips for teaching kids about money

Most parents understand the importance of teaching their children about money and financial responsibility for a successful future. In this article, Warren Buffet offers some top tips from his children’s animated series “Secret Millionaire’s Club", which include starting when they are much younger.